Black Friday: A Retrospective

- Fred Maude

- Reading time: 6 minutes

Another year, another Black Friday, and further shifts in consumer & business habits for us to dig into. We’ve had a look at some really interesting reports from the likes of Microsoft, Nielsen, CNBC & Adobe, alongside some insights from our own clients, to give you the Addesu take on Black Friday 2023. Quick TLDR below, but do dig into the full blog underneath.

Overall, Black Friday sales increased YoY, but did not increase at the same pace as other sale periods seen throughout the year.

Different territories saw very different behaviour – tailor your strategy accordingly.

Not all verticals grew, with Home, Garden, DIY & Alcohol decreasing YoY.

Growth has primarily been driven by new online shoppers. This is likely due to the Cost of Living, the longer term impacts of covid & ever increasing consumer savviness.

The Black Friday period is longer than ever. Shopping habits shifted, consumer patience increased & impulse decreased as greater discounts were anticipated.

Brand loyalty decreased as price sensitivity increased. Customer acquisition is more critical than before as a result with less reliance on retention.

Use the pre-Black Friday period to warm up customers & gather first party data when ad serving costs are lower.

Non-promotional businesses also felt the consumer Black Friday impact. Budgets, tone & activity strategy will have to cater to this behaviour regardless of sale participation.

In general, Nielsen figures show Black Friday online sales grew by 7% YoY in Europe (and similar in the US). The UK & Germany remain the biggest portion of European involvement, with 48% of online shoppers participating in Black Friday in these markets. This goes as low as 33% in Spain, Ireland & Belgium. There are also interesting variants in average spend per shopper, with Germany 41% higher than the UK. This all shows the importance of a tailored international approach with your campaigns, and setting intelligent budgets & targets in different territories.

The majority of this growth is not from individual consumers spending more, but rather from new online shoppers. Our view is that this is, among other things, a knock-on impact of three key factors:

Demographic shifts meaning more people are comfortable buying online

A post-COVID hangover of increased online shopping

Cost of living & price sensitivity is encouraging online price comparisons over traditional high street shopping.

This final point can also be seen via the huge increase in BNPL purchases, with Adobe seeing this growing 47% YoY. Ultimately, these shoppers are also not buying more, or more expensive items, but they are buying from a greater variety of places. An interesting consumer mix has been quietly brewing, with increasing consumer savviness, sophistication & price sensitivity, brand loyalty has been steadily declining. Highlighting the importance of new customer acquisition alongside retention efforts.

At a category level, the story was far more mixed. Electronics, large appliances & beauty saw some of the biggest uplifts, whereas garden, home, DIY & furniture saw declines. In some cases, such as Electronics, the growth seen over Black Friday was a reversal of the performance over the year so far. Some of the drop off categories do tell a story of shifting consumer behaviour, with alcohol products down, as well as many home improvement categories.

Another stand out trend was a continuation of the steady fragmentation of Black Friday. From a day of offers, to a Cyber Weekend of offers, to now often a full week or more of deals. The competitive edge that beating your competitors to the punch can offer has driven businesses to stretch the definition of “Black Friday”. This was seen in many retailers kick-starting their offers in the week prior, and has also continued to impact consumer expectation, visible through their search trends.

Microsoft’s Advertising Report noted that clicks on deal-related terms rose by 17% YoY, with the majority of that growth coming before the BFCM weekend. In turn, we can expect a knock-on impact towards brands strategies next year, with this data likely leading to ever more brands launching their sale campaigns earlier than ever before, as they adapt to capitalise on changing consumer behaviour. As this cycle continues, we seem to be on a one-way street to “Black November”. Brands are left with a decision of extending Black Friday offers, and risk losing sales to competitors, or racing to the bottom and impacting their margins over a longer time period.

On the other end of the scale, customers appear to be delaying their purchases in the hope of steeper discounts as the sale period goes on. Cyber Monday has become an arguably bigger part of the weekend for many brands, driving 17% more searches than Black Friday in the UK. As a takeaway, consumers are searching earlier, but over a longer period of time than ever before. This trend also appears to have been exacerbated this year by an earlier than usual Black Friday, which fell before many people’s final pre-Christmas payday

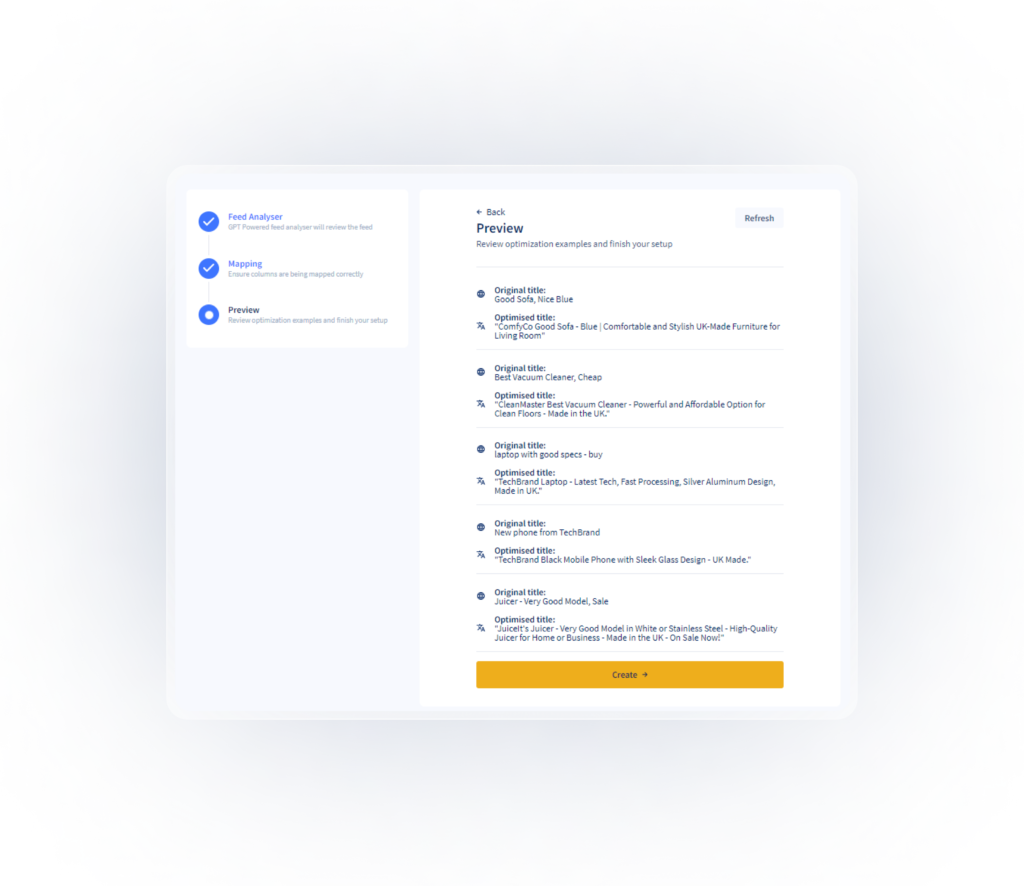

Staying front of mind throughout this period is a huge challenge, and requires a diverse media buying strategy. A lot of Addesu’s clients have seen success with focusing on warming audiences in the build up to Black Friday, then activating these now warm customers with targeted communications during the promotional period itself. All the better if you can get them into your email database beforehand, and then target them for next-to-nothing whilst your competitors are shelling out for inflated CPMs & CPCs. Once Black Friday weekend/week/month begins, it is always more competitive & expensive, and targeting brand-aware users is a sure-fire way to improve results. We pushed clients to invest more in pre Black Friday lead generation campaigns to drive leads, with the added benefit of clearer attribution via first party data rather than relying on flawed platform metrics. It is also important for non-promotional brands to be aware of the Black Friday impact. Our clients saw spikes over Black Friday weekend even if they weren’t running any offers. This is likely the impact of potential customers delaying purchases in the expectation of brands discounting over the weekend. When it didn’t materialise, they still went ahead and made the purchase. Reacting accordingly with budget changes is critical to avoid losing these shoppers at the last hurdle to promotion-heavy competitors. To conclude, it was a mixed year for many retailers. We saw a continuation of long standing trends of more shoppers online, and the discounting period starting earlier &. As always, the key now is taking these wider trends on board, coupled with the results from your own brand or client mix, and applying them to your strategy next year. Onwards & upwards!